Introduction:

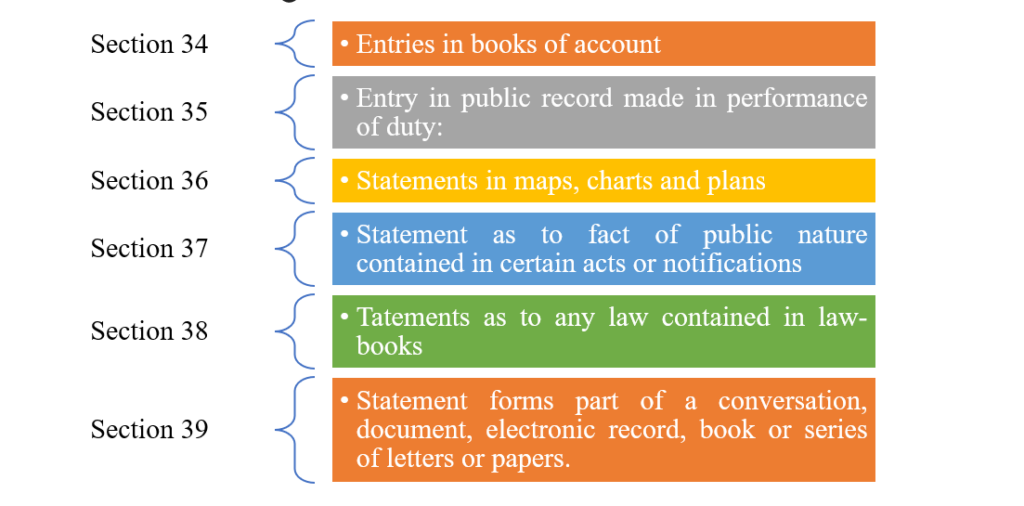

It is a third exception to the hearsay rule. It consists of the statements mentioned in the section 34 to 39 of Indian Evidence Act, 1872 which are considered to be statement made under special circumstances.

Entries in books of account regularly kept in course of Business [Section 34]:

The principle behind S. 34 is that entries made regularly in the course of business are presumed to be truthful and accurate as the chances of any motive or fraud are remote. In order to bring the case U/s 34, the following conditions must be satisfied:

- Entries must be contained in books of account regularly kept in the course of business;

- They must be relevant to the inquiry before the court;

- These entries, though admissible, could not be alone sufficient to charge a person with liability unless corroborated by other evidence.

Meaning of Books of account: The word “Books” signifies a collection of sheets of paper bound together. It should contain successive entries of items which are ultimately balanced or totalled.

The scope of the provision may be explained with help of following illustration:

A sues B for Rs. 1,000/-, and shows entries in his account books showing B to be indebted to him to this amount. The entries are relevant, but are not sufficient, without other evidence, to prove the debt.

Case Laws :

Iswar Das Jain v. Sohan Lal, AIR 2000 SC 426 case, the Court held that extracts from the books of accounts do not fall within Section 34 of the Act and such sanctity can only be attached to the accounts books as a whole, if the books are indeed accounts books.

Narsi Dass vs. Surender, 2015(1) AIC LR 691(P&H): The Punjab and Haryana High Court in held that ‘Bahi’ entries are not the instruments of advancement of loan like pronote, bonds or Bill of exchange etc., which can legally be enforced, as recognised in the Negotiable Instruments Act. These entries are only relevant Us 34 of The Indian Evidence Act, 1872, that too, in case, the same were kept regularly in the course of business.

Venkanna Chowdry v. Lakshmidev amma, AIR 1994 (Mad.) 140case, it was observed any book of account regularly kept and entries made therein in course of business are relevant but are not sufficient by themselves to charge any person with liability where the books of account are maintained by the Managing Partners regarding which other partners made objections regarding entries and if found to vague and false, it is necessary for managing partner to adduce evidence to substantiate entries and prove its genuineness. Stray entries shall not be relevant and note in a diary will not be admissible. Unbounded sheets of paper are not books of account and cannot be relied upon.

Relevancy of Entry in Public Record made in the performance of duty [Section 35]:

The section is also an exception to Hearsay rule. The Entries made in public record in performance of duty are relevant. In order to attract the application of this provision, the following conditions must be satisfied:

- The entry relied upon must be the one contained in any public or official book, register or record;

- It must be an entry stating a fact in issue or relevant fact;

- It must be made by a public servant in discharge of his official duty or by any other person in performance of duty specially imposed by law.

Section 74 of the act gives a list of public documents. Commonly speaking, a public document is one which is made for the purpose of public use. It may be used and referred to by the public at their liberty. a public servant is defined in section 21 of the IPC and further reference may be made to Ss. 74 and 78 of the IEA. Entries relating to the birth and death when registered; entries made on electoral rolls are admissible. A statement made in a private book or register is not admissible under this section.

Relevancy of statements in maps, charts and plans Section 36:

Statements of facts in issue or relevant facts, made in published maps or charts generally offered for public sale, or in maps or plans made under the authority of the the Central Government or any State Government, as to matters usually represented or stated in such maps, charts or plans, are themselves relevant facts.

Maps prepared by private persons are not under the authority of the government and are not admissible unless it is proved that the same was generally offered to the public for sale. The accuracy of such documents shall not be presumed.

Section 83 of the Evidence Act raises a presumption regarding accuracy of maps and plans by government authority.

Section 83. Presumption as to maps or plans made by authority of Government––The Court shall presume that maps or plans purporting to be made by the authority of [the Central Government or any State Government] were so made, and are accurate; but maps or plans made for the purposes of any cause must be proved to be accurate.

Relevancy of statement as to fact of public nature contained in certain Acts or notifications Section 37:

When the Court has to form an opinion as to the existence of any fact of a public nature, any statement of it, made in a recital contained in any Act is a relevant fact.

This section thus makes all government acts and notifications admissible.

Relevancy of Statement Contained in Law Books [Section 38]:

The law of the land requires no proof as the courts are bound to take judicial notice of it under section 57. However, Laws of any other country must be proved like any other disputed fact. It may be proved by giving statement of law contained in the Text books or law reports printed or published under the authority of government of such country. Foreign law may be proved by expert opinion evidence U/s 45 of the Act.

What evidence to be given when statement forms part of a conversation, document, electronic record, book or series of letters or papers.

When any statement of which evidence is given forms part of a longer statement, or of a conversation or part of an isolated document, or is contained in a document which forms part of a book, or is contained in part of electronic record or of a connected series of letters or papers, evidence shall be given of so much and no more of the statement, conversation, document, electronic record, book or series of letters or papers as the Court considers necessary in that particular case to the full understanding of the nature and effect of the statement, and of the circumstances under which it was made.

Section 39 lays down that:

- When a statement, to be proved, is part of a longer statement or conversation or is contained in a book or is a part of a series of letters;

- The evidence shall be given of so much of the statement, conversation, document, book or series of letters;

- As the court considers necessary to the full understanding of the nature and effect of that statement and the circumstances in which it was made;

- That part which does not help in understanding the meaning of the relevant statement need not be proved.

- Only what the court finds necessary in order that the statement may be intelligible is necessary to be proved.

If some kind of evidence is debarred under the Indian Evidence Act, it cannot be brought on record under Section 39.