Introduction:

The Hindu Succession Act , 1956 is an Act relating to the succession and inheritance of property. This Act lays down a comprehensive and uniform system which incorporates both succession and inheritance. This Act also deals with intestate or unwilled (testamentary) succession. Therefore, this Act combines all the aspects of Hindu succession and brings them into its ambit. This article shall further explore the applicability, and the basic terms and definitions and the rules for succession in the case of males and females.

Application

Section 2 of this Act lays down the applicability of this Act. This Act is applicable to:

- Any person who is Hindu by religion or any of its forms or developments,including a Virashaiva, Lingayat, or a Brahmo, Prarthna or Arya Samaj follower.

- Any person who is a Buddhist, Sikh or Jain by religion.

- Any other person who is not a Muslim, Christian, Parsi, Jew, unless it is proved that such person would not be governed by Hindu law or custom.

- This Act shall also extend to the whole of India.

However, this Section shall not apply to any Scheduled Tribes covered under the meaning of Article 366 of the Constitution, unless otherwise directed by the Central Government by a notification in the Official Gazette.

Who qualifies as a Hindu, Sikh, Jain or Buddhist ?

- A legitimate or illegitimate child, where both of his parents are either Hindus, Buddhists, Jains or Sikhs.

- A legitimate or illegitimate child, one of whose parents is a Hindu, Buddhist, Jain or Sikh and is brought up as a member of the tribe, community, group or family to which such parent belongs.

- Any person who is a convert or reconvert to the Hindu, Sikh, Jain or Buddhist religion.

Definitions :

Agnate:

Section 3(1)(a) defines ‘agnate’. A person is said to be an agnate of another if the two are related by blood or adoption wholly through males.

In other words AGNATES Define as Person (male or female) whose relationship is described only through males.

Cognate:

Section 3(1)(c) defines a person to be a ‘cognate’ of another if such a person is related to the other by blood or through adoption but not wholly through males.

Heir

According to Section 3(1)(f), ‘heir’ is any male or female person, who is entitled to receive the property of the intestate.

Intestate

According to Section 3(1)(g), a person who dies without leaving behind a will is referred to as intestate.

Related

According to Section 3(1)(i), ‘related’ means the relationship between kin (kinship), which should be legitimate. Illegitimate children shall be deemed to be related to their mother and to one another, and their legitimate descendants shall be deemed to be related to them and to one another.

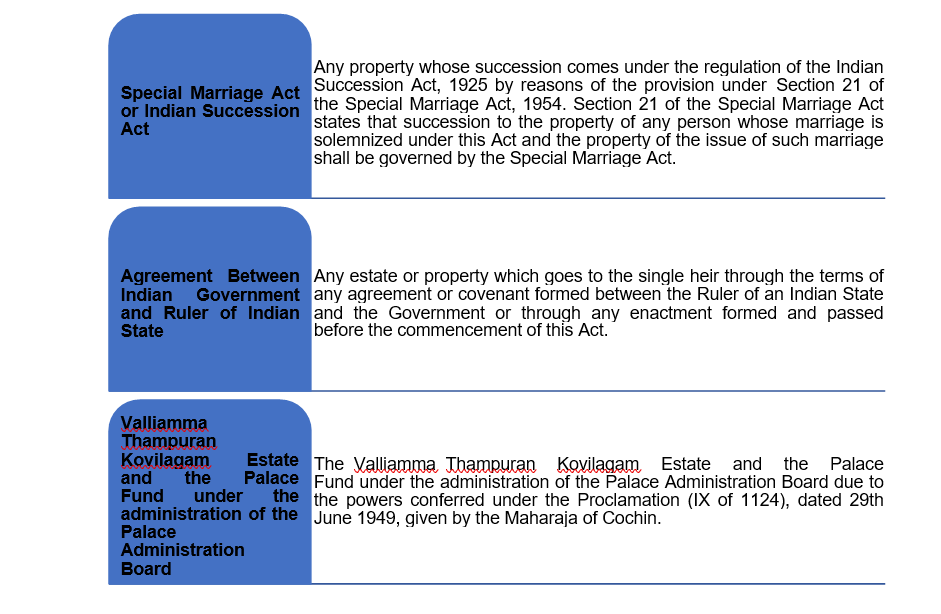

Which properties does this Act not apply to?

Section 5 lays down the properties that this Act does not apply to:

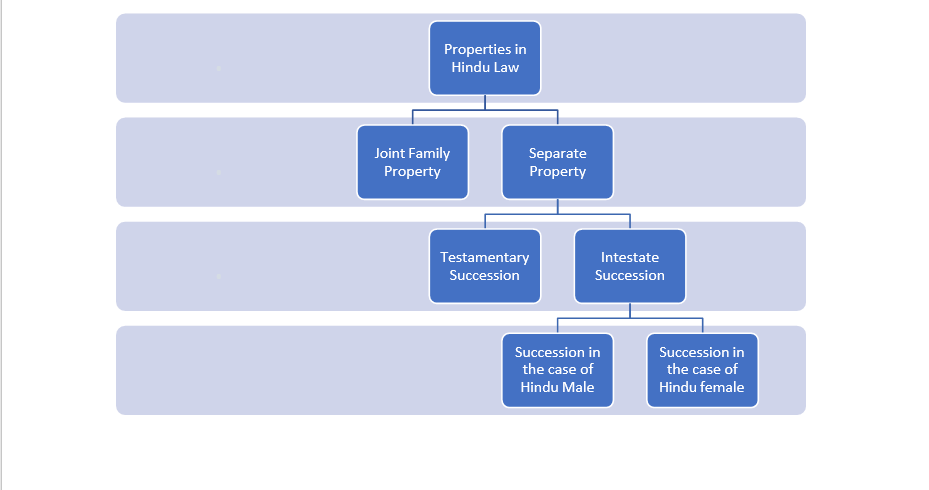

Kinds of succession

In general, succession means the action or process of inheriting a title, property etc. The law of succession is related to legal principle regarding the distribution of assets. We know that there may be two types of properties belongs to a person in the eyes of Hindus :-

- Joint Family Property -Its devolution is based on the rules of coparcenary

- Separate Property- Its devolution is based on Hindu Succession Act

Separate Property is of two types:

Testamentary Succession

When a person makes a will regarding the distribution of the property in favour of anyone, the distribution of the property will be under the provision of the will and not under the law of inheritance. The will should be valid and legally enforceable. This is called testamentary succession. Where the will is not valid, or not legally enforceable, then property can devolve through the law of inheritance.

Intestate Succession

Suppose a person dies without making any will, that how a property is to be distributed after his death. In such circumstance, the property will be distributed as per the law of inheritance. This is called intestate succession.

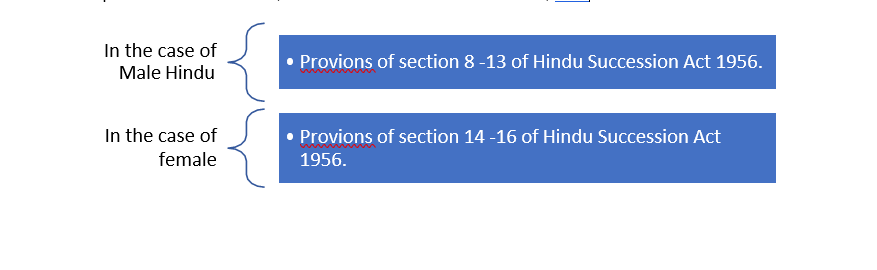

In Intestate succession property shall be devolved among legal heirs as per the provisions of section 8,9 and 10 of Hindu Succession Act, i.e.

Succession in Case of Male Hindu:

Section 8 of the Hindu Succession Act, 1956, prescribes the general rule of succession in the case of a male.

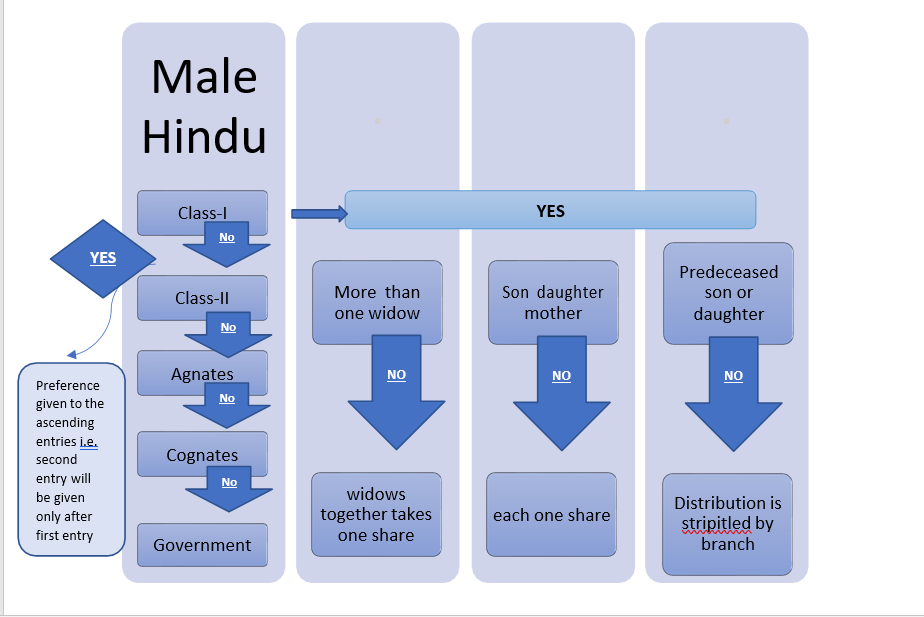

In the case of Hindu Male Succession can be devolved in four categories :

- Class I Heirs

- Class II Heirs

- Agnates

- Cognates

- Government

The person who dies intestate his property will devolve (pass down) upon as per the following tables:

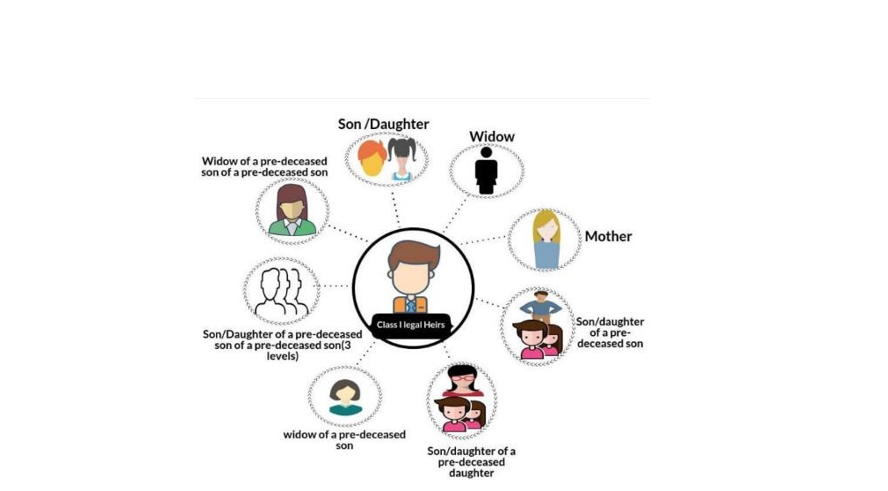

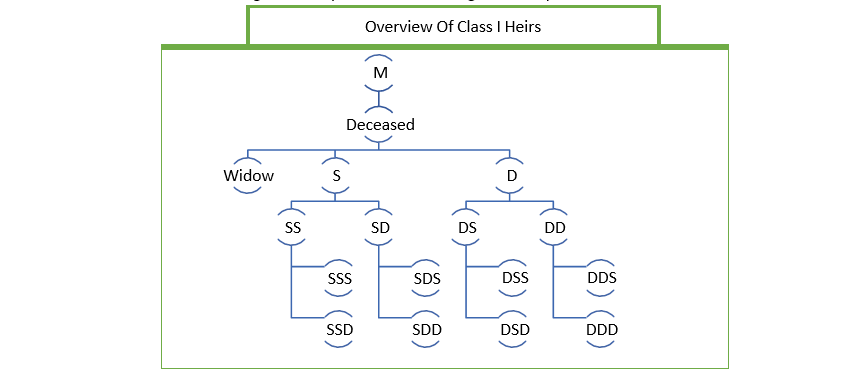

Class I : The following relations are considered to be Class I heirs:

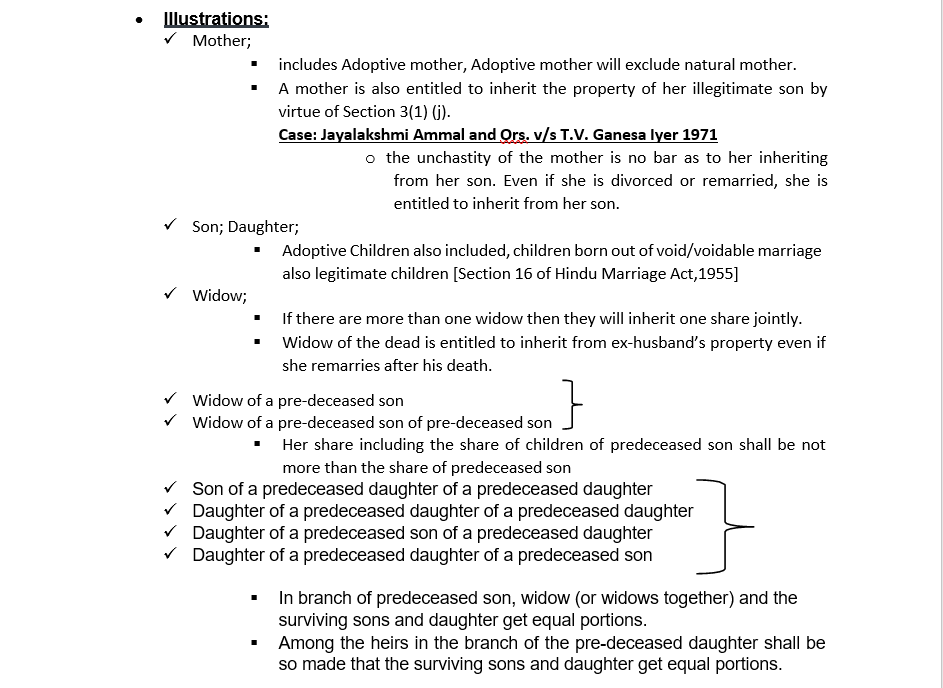

- Widow

- Mother

- Son/Daughter

- Son/Daughter of a pre-deceased son (pre-deceased means “already Dead”)

- Son/Daughter of a pre-deceased Daughter

- Widow of a pre-deceased son

- Son/Daughter of a pre-deceased son of a pre-deceased son (3 levels)

- Widow of a pre-deceased son of a predeceased son

Following are added by the Act No. 39 of 2005 w.e.f. 09.09.2005: –

- Son of a predeceased daughter of a predeceased daughter

- Daughter of a predeceased daughter of a predeceased daughter

- Daughter of a predeceased son of a predeceased daughter

- Daughter of a predeceased daughter of a predeceased son

Example 1:

A person ‘A’ dies without writing a will. He is survived by wife, son and a daughter. In this case, A’s wife, son and daughter come under class 1 heirs. so, all 3 people being class 1 heirs will get an equal share in A’s wealth.

Example 2:

A person ‘B’ dies without writing a will. He is survived by following in the family: wife, son and 2 children of his dead daughter. In this case, there are 3 units: 1 his wife, 1 his son and 1 the children of his deceased daughter. His wife will get 1/3rd share, his son will get 1/3rd share and remaining 1/3rd share will be divided amongst the 2 children of his deceased daughter.

Example 3:

A person ‘C’ dies without writing a will. His wife is already dead. He is survived by 2 sons and 2 daughters. All of them are married. In this case, the wealth will be equally divided between his 2 sons and his 2 daughters. Each one will get 1/4th share in the wealth.

Distribution of property among Class-I Heirs (Section 10) :

- The widow (or widows), mother and each of the children (son or daughter) the law makes no distinction [section 6] takes equal share

- Where one or more sons or daughters is no more, than the Class-I heirs in that branch will all jointly stand in the place left behind by such deceased son or daughter and shall take between them one share

- If there are more than one widows, all the widows together shall take one share

In case there are no relatives as per class-I heirs available, then the property will distributed among class-ii heirs.

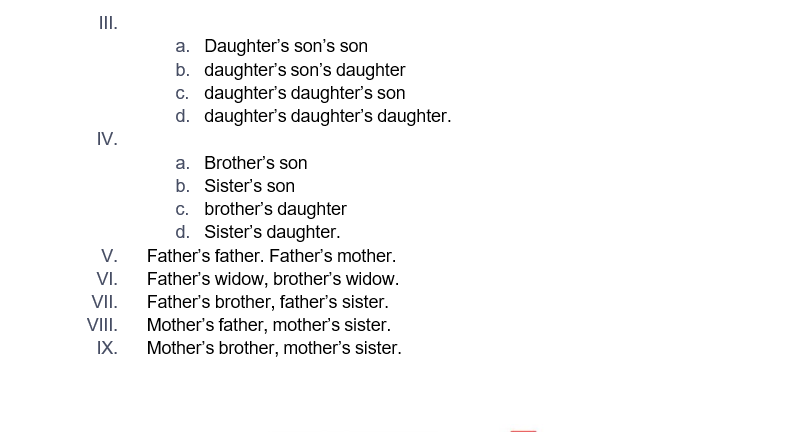

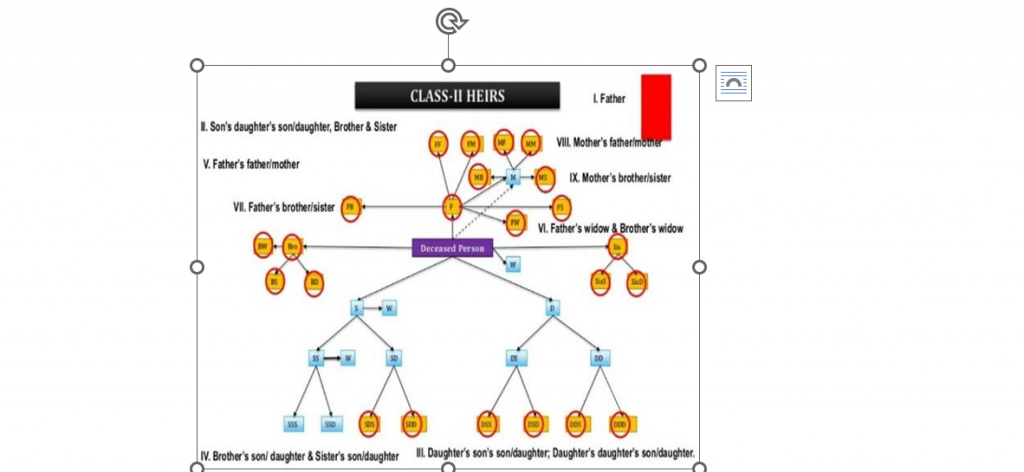

Class II Legal Heirs

In case no Class-I heirs are available, Class-II heirs, are considered. Among the heirs specified in Class II, those who are mentioned first get the property simultaneously and in exclusion to those in the subsequent entries. In other words there are total nine entries in Class-II. Devolution of property is based on these entries in Class-II heirs , firstly whole property shall be devolved upon first etnry if there is no one in first entry than whole will be goes to second entry and so on.

For example, if the father is no longer alive, then the second in list such as “(1) Son’s daughter’s son (2) son’s daughter’s daughter, (3) brother & (4) sister” will get the property in equal measure, provided all the heirs are available.

I. Father

Includes adoptive father, father is not entitled to property from illegitimate son unlike mother but he is entitled to inherit property from children born out of void and voidable marriages.

II. As below

- Son’s daughter’s son

- son’s daughter’s daughter

- brother

- sister.

Case: Arunachalathammal v/s Ramachandran Pillai (1962)

In the case of Arunachalathammal v. Ramachandran, it was contended that the different heirs mentioned in one entry (Class I of Class II) are subdivisions of that particular entry and they do not inherit simultaneously but here again, there is a question of preference i.e. the first subdivision inherits and then in its absence, the later. The question arose because there were, in his case, one brother and five sisters of the intestate and no other heir and the brother contended that in a brother being in subcategory (3) of entry I, was to be preferred over sister who was in subcategory (4) of entry I and thus he was entitled to the full property.

However the same was negated and it was held that “all heirs in an entry inherit simultaneously and there is no preference to an heir in a higher subcategory within an entry to an heir in a lower subcategory in the same entry. Thus we find that the equality is between every individual heir of the intestate and not between the sub-division in any particular entry. In fact, the court went on to say that there were no subdivisions in any entry in Class II. They were just roman numerals representing the heirs in the entry.”

· Distribution of Property among Class-II Heirs :

The property of an intestate shall be divided between the heirs specified any one entry in class-II so that they can share equally.

If there are no relative as per class-II heirs too, then the property will be given to the agnates of the deceased person.

- Some Examples of Class-I and Class-II Heirs

EXAMPLE 1

A male dies leaving behind father, mother, widow, one son and one daughter surviving him. The deceased also had one other daughter who predeceased him, the predeceased daughter had husband, one son and one daughter, all of whom survived the deceased. In the given case, the father of the deceased and the husband of the predeceased daughter will not inherit anything. The mother, widow, son and the surviving daughter will get one-fifth share each in the property of the deceased, while the son and daughter of the pre- deceased daughter will get one-tenth share each.

EXAMPLE 2

A male dies leaving behind mother, father, brother and sister. In this case, the mother will succeed to the entire property.

EXAMPLE 3

A male dies leaving behind father, brother and sister. In this case, the father will succeed to the entire property.

EXAMPLE 4

A male dies leaving behind two brothers and one sister. In this case, the property will be divided equally between the three siblings.

- It may be noted that words such as son, daughter mean legitimate son or daughter and includes a son and daughter who are adopted but does not include a step-son or a stepdaughter. A posthumous son or daughter is also included. It is also immaterial whether the daughter is married or not. Brother or sister includes brother and sister by full blood, by half blood and by illegitimate relationship. Full blood will, however, take preference over half blood.

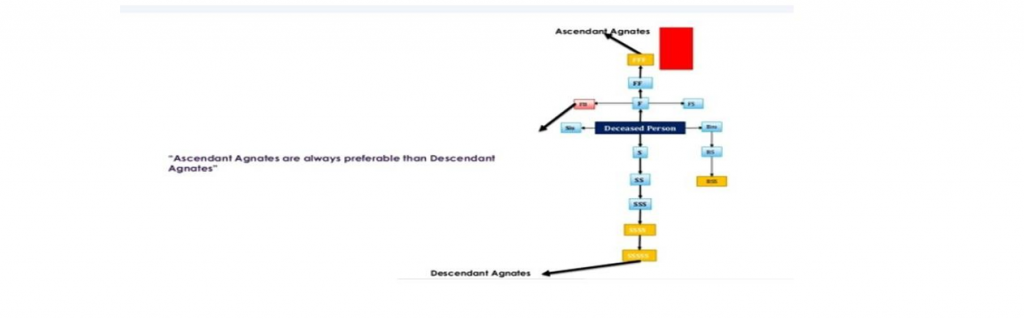

Agnates (section 12)

If there are no heirs in Class II, the property will be distributed to the deceased’s agnates (a male or female descendant by male links from a common male ancestor) or relatives through male lineage (for example first cousin and their children).

- Agnates of the intestate do not include widows.

- There is no limit to the degree of realtiuoinship by which an agnate is recognized. Hence , an agnate however remotly related to the intestate may succeed as an heir.

- This relationship does not distinguish between male and female heirs.

- There is also no distinction between those related by full and half blood. However , uterine relationship is not recognized.

Cognates (Section 12)

If there are no agnates or relatives through the male’s lineage, then the property is given to the cognates (One related by blood or origin with another, especially a person sharing an ancestor with another), or any relative through the lineage of males or females (for example, second cousin and their children).

- Cognate relationship is also not based on marriage and only on blood or adoption. Hence widow or widows of those related by cognate relationship do not fall under the category and hence they are entitled to succeed on this ground.

- If there are no cognates too than all the property of the deceased person will go to the Government.

Doctrine of Escheatment:

The term ‘escheat’ means a reversion to the state in the absence of legal heirs. If a person dies intestate leaving no heirs whatsoever, then the doctrine of escheat can be invoked, whereby the estate of the deceased reverts to the state.

For example, if A dies intestate (i.e., without making a will) and it turns out that he has no legal heirs or claimants, then the state shall assume the permanent ownership or temporary custody of his property.

The question of escheatment arises :

- When a Hindu estate has left no legal heir

- It is pertinent to note that the law of escheats shall have no application if there are legal heirs of the deceased or if the deceased has died after making a will.

- When the intestate has left an heir who is statutorily disqualified from succeeding Section 25 to 28 which are :

- Murderer [Section 25]

- Abettor of Murder [Section 25]

- Converts Descendants [Section 26]

- Two of the most important conditions for the claim of escheat to succeed are proof of the absence of heirs and the giving of a public notice for the claimants to come forward.

- When the intestate has left an heir who is statutorily disqualified from succeeding Section 25 to 28 which are :

Legal provisions regarding the doctrine of escheat: Section 29 of the Hindu Succession Act, 1956

In Indian law, the principle/doctrine of escheat is embodied in Section 29 of the Hindu Succession Act, 1956. Section 29 provides for “Failure of heirs”. It states that “if an intestate has left no heir qualified to succeed to his or her property in accordance with the provisions of this Act, such property shall devolve on the Government; and the Government shall take the property subject to all the obligations and liabilities to which an heir would have been subject.”

Thus, as per the doctrine of escheat, when an individual dies intestate and does not leave behind any heir who is qualified to succeed to the property, the property shall devolve on the Government. However, the government takes the property subject to all its obligations and liabilities.

- Constitutional Provisions

Article 296 of the Constitution of India provides for ‘Property accruing by escheat or lapse or as bona vacantia’. Article 296 makes it clear that the principle of escheat as applicable prior to the enactment of the Constitution would continue.

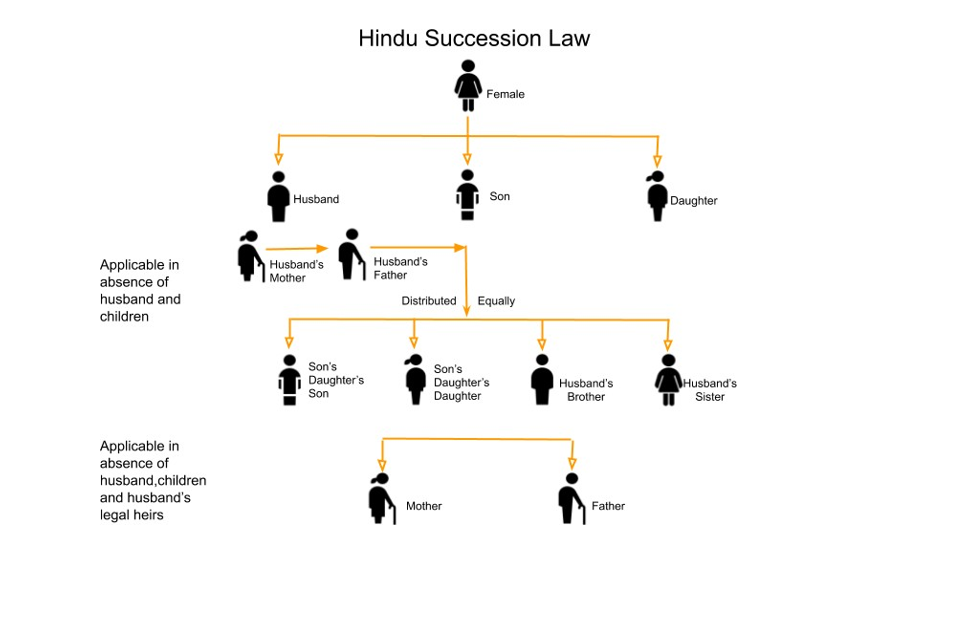

Rules for ownership in the case of females

With the coming of The Hindu Succession Act, 1956, women are granted ownership of property, whether it was acquired before or after the commencement of the Act, thus abolishing their ‘limited owner’ status. But it was only in the Hindu Succession (Amendment) Act, 2005 that it was decided that daughters would be entitled to an equal share in the property as the son. Therefore, the 2005 Amendment serves as a defender for female rights.

If a Hindu female dies without a will,her property (if she is the full owner of the property) would be distributed as follows :

- Firstly, upon the sons and daughters, which would also include the children of a predeceased son or a predeceased daughter) and the husband.

- Secondly, on the heirs of the husband.

- Third, upon the mother or the father.

- Fourth, on the father’s heirs.

- Fifth, on the heirs of the mother.

Under section 14 “property” includes both moveable and immovable property acquired by a female Hindu

- By Inheritance or devise or at partition or in lieu of maintenance or arrears of maintenance

- By gift from any relative or non-relative or after her marriage

- By her own skill or exertion

- By purchase

- By prescription

- By her Sridhana or in any other manner whatsoever held by her

Certain Rules regarding Hindu Female dies intestate

- In case of a Hindu female dies intestate and without any issue or any children or any predecessors’ children, any property inherited by her from her parents shall not devolve upon her husband or his heirs but revert to her natal family [Section 15 (2)-a]

- In case of a Hindu female dies intestate and without any issue or any children or any predecessors’ children then any property inherited by her husband, or her father-in-law devolves the heirs of her husband

Certain Exceptions and Provisions in Hindu Succession Act

- Any person who commits murder is disqualified from receiving any form of inheritance from the victim. [section 25 ]

- Cases:

- Minoti vs. Sushal Mohan Singh (1982) : The word “murder” used in section 25 in Hindu Succession Act 1956 includes culpable homicide or unlawful manslaughter

- Chammanlal vs. Mohanlal (1977) : If a person charged with murder is acquitted , the acquittal removes disqualification

- If a person converts from Hinduism, he or she is still eligible for inheritance but his/her descendants are disqualified for inheritance [section 26]

- A child in womb at the time of the death of an intestate shall have the right to inherit (if the child is subsequently born alive) [Section 20]

- Widows remarrying are entitled to inherit as widow as prior to 2005 , widows was to be disqualified under section 24 of Hindu Law but now this section has been repealed after Amendment Act 2005

- No persons shall be disqualified from succeeding to any property on the ground of any disease, defect or deformity etc. [section 28]

- hen two persons dies simultaneously, the presumption is that the elder dies first and the younger survived the elder. [Section 21]

The 2005 Amendment To Hindu Succession Act

The Hindu Succession (Amendment) Act 2005 was assented by the president on 5th September 2005 and came into effect from the 9th September 2005. This amendment was brought about to end the discrimination in the Hindu Succession Act 1956, section 6, thus abrogating the survivorship rule. Under this amendment of the section if a person dies intestate the property would be inherited to class I heirs which consist of the widow, son and daughter of the deceased and the property would be divided equally among them. In the absence of class I heirs due to any reason then the property would pass down to class II heirs and so on. This act also amended the section 4, section 23, section 24 and section 30 of the act.

This amendment was brought as a solution and it was declared that daughters also have an equal right and liability in the father’s property just like the sons and daughters are entitled to this right since birth.

CONFUSION BEHIND THIS ACT ?

Though this act was brought about as a solution, there were certain confusions surrounding this amendment. The enforcement date of this act was 9th September 2005. The main question was that ,will this law be applied retrospectively or is it applicable for future cases only? This meant that if a person died in 2002 that is before the enforcement

of this amendment, would the daughter still be entitled to the property and would she be a co-parcener?

CASES WHICH SOLVED THIS CONFUSION

The case of Prakash & others vs Phulavati &others, which came in 2016, dealt with the above question that whether this law will have a retrospective effect or no. This case was headed by a two judges bench Justice Anil Dave and Justice A K Goel in the Supreme Court and they held that the rights under this amendment would be available to those daughters whose fathers were living on the date of enforcement of this amendment. This has been declared as a landmark judgement for it held that only living daughters of living co-parceners are entitled to the property.

The second case regarding the same question came up in 2018. In the case of Danamma vs Amar, the Supreme Court was headed by a two judges bench- Justice AK Sikri and Justice Ashok Bhushan, this time held that the rights under the 2005 amendment would be applicable to the daughter even if the father is not alive on the enforcement date of the amendment, thus making both the daughters and sons equally liable for the property and this right is given to both of them since birth.

Even though in 2018, the judgement was passed in favour of daughters having equal rights over the father’s property, there were still some confusions and confusions on whether to follow the 2016 judgement or the 2018 one.

Finally, in 2020 the case of Vineeta Sharma vs Rakesh Sharma put an end to all the speculations surrounding the applicability of this amendment. The earlier cases were headed by a two judge bench but in this case it was headed by a three judge bench and they were Justice Arun Mishra, Justice Abdul Nazeer and Justice M.R Shah. The Supreme Court in this case clearly said that daughters and sons have an equal liability over a property and that this right is given to them since birth and whether the father is alive or dead, it doesn’t affect the right of the daughter.

CONCLUSION

The law of inheritance under Hindu law is complex in nature and is arduous to understand. However, the rules that are in place allow the succession of property in an efficacious manner and the smooth functioning of the division of property. Although there is an entire Act that governs the rules of inheritance, the above-mentioned sections are some of the few important laws which have enabled the judges to pass landmark judgments and also pass a significant amendment for the wider purview of this enactment.

It took years for the legislation and judiciary to understand the needs of females in cases of inheritance to the family property, but with the amendment in 2005, the court has been able to successfully broaden its outlook towards women and give preference to them in the line of succession. However, India as a country still lags behind when it comes to giving women their rights in accordance with the law of the country. Hence, the country is far away from achieving equality by passing unbiased laws with reference to gender.

_______________________________________________________________________________________