Tangible movables such as tables or cars have physical existence and can be possessed. But intangible movables being in the form of rights, have no physical existence and cannot be possessed. The existence of a tangible movable can be known simply by it’s physical presence, but the existence of intangible movable property may be known only when the person having such interest claims it by maintaining an action in a court of law.

For example, If A has a table, it can be known by seeing the possession of table with A. But if A has right or claim to get back the money given by him to B, then A’s claim can be known only when he files suit against B for the recovery of his money.

In other words, A’s claim against B can be known only when he maintains action in a Court of law. It may be stated, therefore, that beneficial interest of a person in some movable property is an actionable claim of that person.

The definition of actionable claim was included in Section 3 of the Transfer of Property Act in 1900.

Definition of Actionable Claim

According to Section 3, actionable claim means:

- Unsecured money debt, and

- a claim to beneficial interest in movable property not in possession of the claimant.

- Unsecured money debt.-A debt may be secured or unsecured.

Secured Debt : Where the creditor (the person who gives loan) takes security from the debtor (the person who takes the loan) for repayment of his money, the debt is secured debt. It may be of following :

Mortgage : If debtor gives the security of his immovable property, the debt is secured by way of mortgage.

Pledge : Where security is some movable property, it is pledge or hypothecation.

Unsecured Debt : If there is no security of any movable or immovable property, the debt is unsecured. When a person takes some loan and simply writes a pronote, the debt is an unsecured debt.

According to Section 3 only unsecured debt is an actionable claim. Debt secured by way of mortgage, pledge or hypothecation is not an actionable claim.

It may be noted that ‘debt’ here does not mean only ‘loan’. Any obligation to pay a certain or definite sum of money may be called a ‘debt’.

An actionable claim is for a fixed sum of money or in a certain sum of money. When the sum of money is not fixed it is not the actionable claim but a right to sue.

For example : Maintenance, areas of rent, the Muslim dower, insurance money these are some of the examples of actionable claim.

And the claims under tort like defamation and damages are examples of right

to sue.

In the case of sunrise associates versus government of NCT of Delhi, AIR 2006, SC 1908. It was held that the actionable claim can be existent or of accruing nature also.

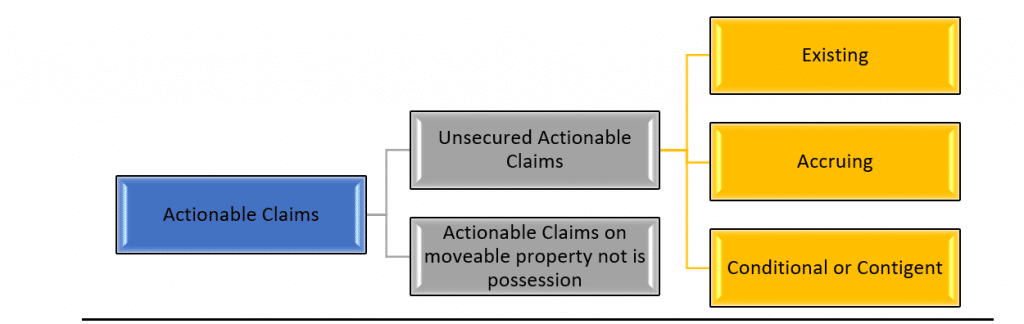

Kinds of Actionable Claims:

Unsecured Debt :

- Existing

Which is already there, means it exists. For example present and past maintenance our transferable because they are existing but not future maintenance.

- Accruing :

It has been pending, not paid. Means the right which has already outstanding. It keep on adding or adding month by month so the maintenance is accruing. It accrued till the death of the husband.

For example Rent also.

- Conditional or Contingent : Where the claim for a sum of money exists but the payments depends upon the fulfilment of any condition. The debt is conditional.

It A promises to give Rs. 1,000 to B provided he marries C within one year, then B’s claim to Rs. 1,000 is conditional because it is subject to a condition to be fulfilled by him in future.

Similarly, where the claim of money is subject to some uncertain future event which may or may not happen, the claim is contingent. For example, where A promises to give Rs. 1000 to B provided B’s first child is a son, the claim of B for Rs. 1000 is contingent claim (debt).

- Claim to beneficial interest not in possession of the claimant.-Right of a person to take the possession of a movable property from the possession of another, is the actionable claim of that person provided claimant has beneficial interest (i.e. right of possession) in that property.

Following requirements are necessary for constituting an actionable claim-

(a) The claim is to some movable property.

(b) The movable property is in possession of another person.

(c) The beneficial interest or the right of possession of the claimant is recognised by the Court.

Illustrations

As far as the interest in movable property is concerned the example could be that A went to B for buying hundred kgs of wheat. B said it is in my godown and I will sell it to you.

But no delivery either actual or constructive was given but the contract was concluded. Next day if B refuses to deliver the goods then he has a right to claim those and such rights would be called as actionable claims.

Transfer of actionable claim, section 130.

- Suppose A goes to B for a loan and B ready to give loan without any security this is the example of actionable claim. Now B has right to recover the money from A but B transferred his right to recover loan to C. Now the debt would be paid by A to C and not to B. B can do so under section 130.

- An actionable claim can be transferred only by an instrument signed and in writing. The section makes it very clear that it has to be in writing. So therefore, there cannot be an oral assignment.

- An important aspect of transfer is that it is complete only and at the time when it is signed by the transferee.

- So logically even if the person who has the liability may not be aware about the transfer but still the transfer has been taken place. This is due to the fact that the section lays down that even if no notice is given the transfer would be complete.

- So for example if D has an actionable claim towards the B. B transfer it to C the moment it is signed by the transferor it is complete, and now all the rights and liabilities stands transferred in the name of C. Section 130(2), provides that when the instrument is complete all the rights now belongs to transferee which means that in above example to C.

- Notice to be given in writing : Section 132 further clarifies that if the transferee is getting the rights he is also having all the liabilities. Section 135 lays down that a notice of transfer of actionable claim should be given in writing, signed by the transferor or his agent but if the transferor refuses, the notice can be given by transferee providing details of the transfer.

- So in the above example, B who is the transferor should give the notice and upon his failure it is the duty of C who should be giving the notice. Obviously, a notice should be given because there is a change in the rights and liabilities and the transferee has also been given the rights because ultimately now the rights to recover the money belongs to the transferee, so he is very well within his rights to give notice or rather than knowledge to that your liability is now towards me and not B.

- But suppose if A received the notice, A has a knowledge about the transfer and now he is legally bound to pay to C and not to B, if no notice is received by A what happened then is he liable towards C ?

The answer is yes because the transfer is complete on signing, execution, even if no notice was given. He is liable towards C.

- If A has received no notice and now B demand money from A and here, he paid the amount to B, despite the transfer but he had no knowledge of transfer. Here this payment is valid because he has done no mistake.

Therefore, notice is required to be given by C to A. No doubt B can be sued for fraud but better option is to give notice.

What are not actionable claim —

- A decree passed by the Court for recovery of a debt,

- Right to get damages for breach of contract held in the case Moti lal vs Radhe Lal 1933,

- Copyright,

- Right to obtain gain from a co-sharer

- Mesne profits that is claim of produce of profit of a disputed property by decree holder who was not in possession of the property , held in the case of Jai Narayan vs Kishun Dutta 1924.

________________________________________________________________________________